Abstract: “The financial obligation trap theory implicates payday advances as a factor exacerbating customers’ economic distress. Appropriately, limiting use of pay day loans will be likely to reduce delinquencies on main-stream credit services and products. We try out this implication regarding the theory by analyzing delinquencies on revolving, retail, and installment credit in Georgia, new york, and Oregon. These states paid off option of payday advances by either banning them outright or capping the charges charged by payday loan providers at a level that is low. We find tiny, mostly good, but usually insignificant alterations in delinquencies following the cash advance bans. In Georgia, nonetheless, we find blended evidence: a rise in revolving credit delinquencies but a decrease in installment credit delinquencies. These findings claim that pay day loans might cause harm that is little providing advantages, albeit little ones, for some customers. With an increase of states additionally the federal customer Financial Protection Bureau considering payday regulations that could restrict accessibility to a product that seems to gain some customers, further research and care are warranted.”

Abstract: “Payday loan providers as a supply of tiny buck, short-term loans has expanded exponentially within the last two years. Getting started as easy storefront outlets in about 200 areas into the early 1990s, the industry expanded a lot more than twelve-fold because of the final end of 2014. As the development of this cash advance industry is apparent, there is absolutely no basic consensus on whether or not the item provided is helpful to those that borrow through this medium additionally the industry’s long-lasting impact upon culture. Nearly all policies, legislation, and limitations in the pay day loan industry is administered in the state degree. Presently, 13 states prohibit payday lenders to use in their respective state boundaries through different legislation and statutes. Associated with 33 states that enable cash advance operations high risk installment loans, restrict that is most them in certain way through maximum rates of interest, loan quantities, and payback durations. Some Federal oversight does exist in governing the payday loan industry beyond state-based legislations. All of the oversight that is federal created through previous Congressional action like the Truth in Lending Act and through government agencies like the Federal Trade Commission. Nevertheless, federal reach keeps growing through newly produced teams including the customer Financial Protection Bureau. Payday lending continues to evolve beyond old-fashioned geographic boundaries and into areas such as for example internet-based loan providers. This produces a host in which confusion reigns as to jurisdiction that is legal. Due to the doubt of current guidelines and just how they connect with the payday lending, evolving legislation will stay to the near future.”

“Banks and Payday Lenders: buddies or Foes?”

Abstract: “This paper investigates the geographical circulation of payday lenders and banking institutions that run through the united states of america. State-level information are accustomed to suggest variations in the environment that is regulatory the states. Offered the various constraints on interest levels as well as other areas of the loan that is payday, we empirically examine the connection amongst the quantity of payday lender shops and different demographic and economic traits. Our outcomes suggest that amount of stores is absolutely associated with the portion of African-American populace, the portion of populace that is aged 15 and under additionally the poverty price. The sheer number of shops can also be adversely pertaining to earnings per capita and academic amounts.”

“Payday Loan Choices and Consequences.”

Abstract: “High-cost credit rating has proliferated in past times two years, increasing scrutiny that is regulatory. We match administrative information from the payday lender with nationally representative credit bureau files to look at the options of cash advance candidates and assess whether payday advances assist or harm borrowers. We find customers submit an application for payday advances once they have restricted access to conventional credit. In addition, the weakness of payday candidates’ credit records is longstanding and severe. According to regression discontinuity estimates, we reveal that the results of payday borrowing on fico scores as well as other measures of monetary wellbeing are near to zero. We test the robustness of the null results to a lot of facets, including options that come with your local market framework.”

Abstract: “We exploit an alteration in lending laws and regulations to calculate the causal aftereffect of limiting access to pay day loans on alcohol product sales. Leveraging lender- and alcohol store-level information, we discover that the noticeable changes reduce sales, utilizing the biggest decreases at shops positioned nearest to loan providers. By centering on states with state-run alcohol monopolies, we take into account supply-side factors which can be typically unobserved. Our email address details are the first to ever quantify exactly just just how credit constraints affect shelling out for alcohol, and recommend mechanisms underlying some loan usage. These outcomes illustrate that the many benefits of lending limitations stretch beyond individual finance and can even be big.”

Abstract: “In the previous couple of years, payday financing has mushroomed in a lot of developed nations. The arguments pros and cons a market which offers little, short-term loans at extremely interest that is high have blossomed. This short article presents findings from an Australian study to play a role in the worldwide policy and exercise debate of a sector which orients to those on an income that is low. In the middle of the debate lies a conundrum: Borrowing from payday loan providers exacerbates poverty, yet numerous households that are low-income on these loans. We argue that the problem that is key the limited framework within that the debate presently oscillates.”

“In Harm’s Method? Cash Advance Access and Military Personnel Efficiency.”

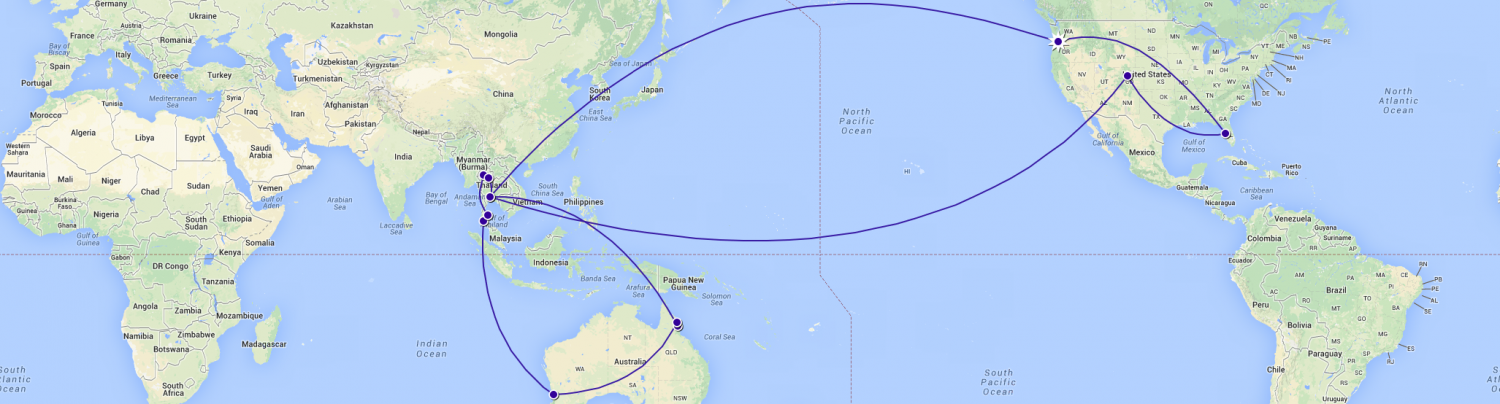

Abstract: “Does borrowing at 400% APR do more harm than good? The U.S. Department of Defense believes therefore and effectively lobbied for the 36% APR cap on loans to servicemen. But evidence that is existing exactly just exactly how usage of high-interest financial obligation impacts borrowers is inconclusive. We estimate effects of cash advance access on enlisted workers making use of variation that is exogenous Air Force rules assigning workers to bases over the united states of america, and within-state variation in lending guidelines in the long run. Airmen task performance and retention decreases with cash advance access, and seriously bad readiness increases. These impacts are strongest among reasonably inexperienced and economically unsophisticated airmen.”

Abstract: “The annualized rate of interest for a quick payday loan usually surpasses 10 times compared to a credit that is typical, yet forex trading grew immensely when you look at the 1990s and 2000s, elevating issues in regards to the risk pay day loans pose to customers and whether payday loan providers target minority communities. This paper employs credit that is individual data, and census data on payday lender store places, to evaluate these issues. Benefiting from a few state legislation modifications since 2006 and, after past work, within-state-year variations in access as a result of proximity to states that enable payday advances, I find small to no aftereffect of pay day loans on fico scores, brand new delinquencies, or the probability of overdrawing credit lines. The analysis additionally shows that community racial composition has small influence on payday lender shop places depending on earnings, wide range and demographic traits.”

Abstract: “This response covers Eric J. Chang’s article, ‘www.PayDayLoans.gov: A Solution for Restoring Price-Competition to Short-Term Credit Loans.’ It provides some proof from present empirical research to declare that the federally operated online change that Chang proposes for payday financing markets is not likely to achieve assisting cost competition. It contends that loan providers are unlikely to voluntarily take part in the exchange and that, even when they did, numerous borrowers are not likely to make use of the exchange.”

Tags: finance, borrowing, loans, poverty, usury, predatory financing, alternative banking